Arpan Tiwari

Arpan Tiwari is a results-driven Realtor specializing in Mechanicsburg, PA, and surrounding area in Central, PA markets. With a background in Business Marketing and AI, Arpan leverages data-driven strategies to help clients buy and sell homes with confidence. A content creator on YouTube, he provides insights on relocation, market trends, and real estate investments. Passionate about technology and efficiency, he also explores AI automation in the Real Estate market and is actively involved in research and business ventures.

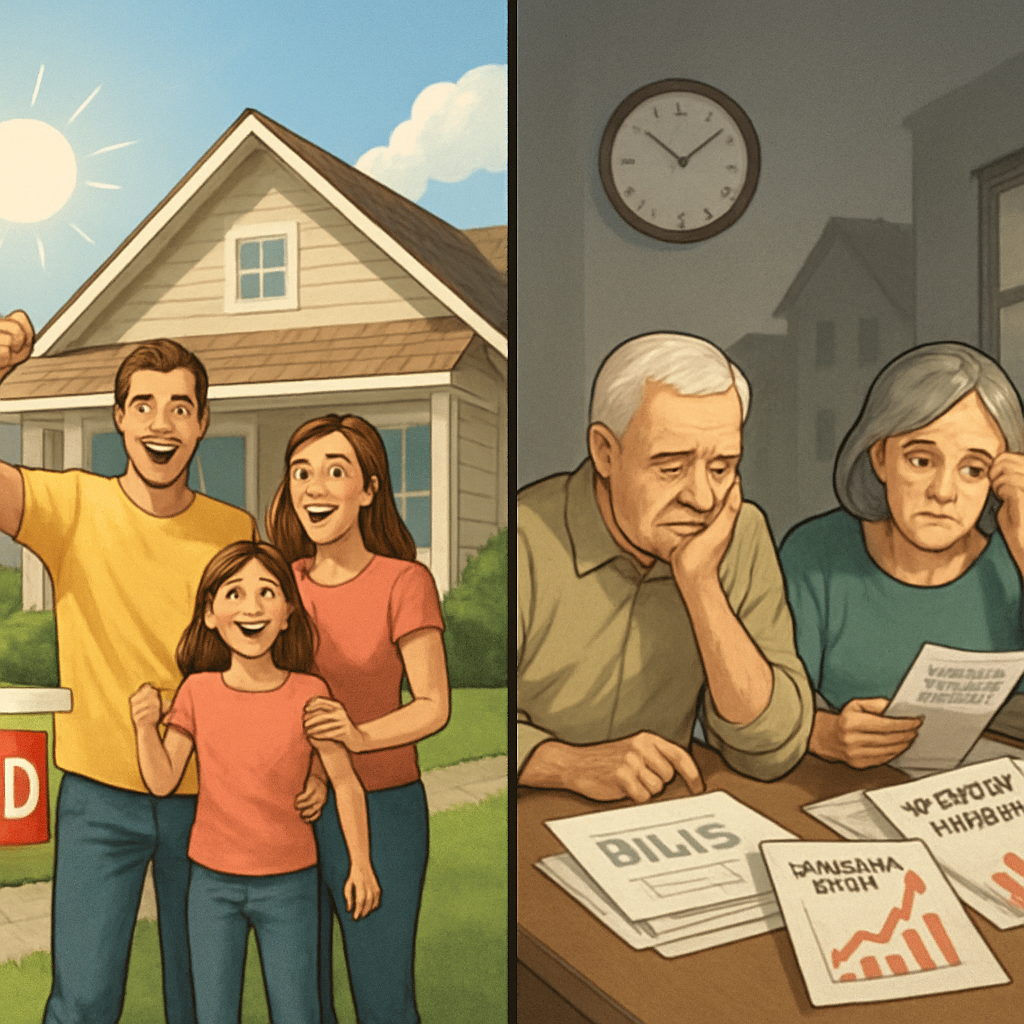

The conversation around housing affordability has taken a sharp turn with former President Donald Trump’s suggestion of introducing a 50-year fixed mortgage. While the headline promise—lower monthly payments—sounds appealing, the deeper financial consequences tell a different story. Extending mortgage terms to half a century would be unprecedented in the U.S., and experts warn that it could create far more harm than help for American homeowners.

Why a 50-Year Mortgage Raises Red Flags

A mortgage that stretches across five decades is essentially uncharted territory. Housing economists emphasize that most people do not fully understand the long-term financial implications of such a loan. The danger isn’t just in the length—it’s in how much more you pay over time and how little equity you build along the way.

The 30-Year Mortgage: Familiar but Imperfect

Even today’s standard 30-year mortgage is far from ideal. In the early years, the majority of payments go toward interest rather than principal. That means slow equity growth, especially considering that the average American homeowner sells after just 12.3 years. By the time many people move, they’ve barely touched the loan’s principal, leaving them with limited wealth-building benefit from homeownership.

The Appeal Behind Trump’s Proposal

Trump argues that extending mortgages to 50 years could help more people qualify for homeownership. Spreading payments over a longer period does reduce monthly costs, which could allow buyers to stretch into higher price ranges. The idea has generated buzz, especially among first-time buyers struggling with high home prices and elevated interest rates.

But financial professionals across the board are sounding alarms: an easier payment today can become a financial trap tomorrow.

Why 50-Year Mortgages Don’t Strengthen the Market

On paper, a 50-year mortgage seems like a shortcut to affordability. In reality, it introduces new risks:

-

The longer the loan, the more interest a homeowner pays—sometimes hundreds of thousands extra.

-

Buyers may feel comfortable in the short run but become financially strained during economic downturns.

-

The housing market becomes more vulnerable when homeowners carry larger, long-term debts.

In simple terms, these mortgages might make monthly payments prettier, but the long-term picture gets uglier.

Minimal Affordability Gains, Maximum Debt

Surprisingly, shifting from a 30-year to a 50-year mortgage doesn’t automatically reduce payments the way people expect. In some cases, monthly payments can even increase due to risk-based interest rates. Longer loan terms typically come with higher interest costs, so while buyers see small savings upfront, they shoulder significantly more debt over time.

Homebuyers Could Face Greater Financial Risk

Being able to qualify for a bigger home is tempting. But experts caution that the true savings of a 50-year mortgage would likely depend on government subsidies—something far from guaranteed. Without these, buyers may find themselves locked into expensive long-term obligations that offer little real benefit.

On top of that, lenders and investors face increased exposure. The longer the loan term, the greater the risk during housing downturns, making the entire mortgage system more fragile.

Why Banks Are Skeptical of Ultra-Long Loans

Banks prefer shorter-term mortgages because they provide more predictable returns. A 50-year loan ties up capital for decades and exposes lenders to losses when interest rates fluctuate. If rates drop in the future, banks could be stuck earning lower yields for an extremely long time—something they are unlikely to accept without major policy changes.

Legal Barriers and Higher Costs Ahead

There’s another layer: implementing 50-year mortgages would require a rewrite of existing housing laws. Under current regulations, particularly post–Dodd-Frank, many protections and underwriting standards would need to be rebuilt to accommodate such long-term debt. Without those changes, the idea simply isn’t feasible.

Plus, the front-loaded interest structure would leave borrowers paying significantly more early on—further driving up total lifetime costs.

Even Trump Critiques the Idea

Interestingly, Trump has criticized the concept himself. While floating the idea of longer mortgages, he also acknowledged that a 50-year loan doesn’t meaningfully improve affordability. He suggested allowing mortgage interest deductions for new loans issued after 2026—up to $1.5 million—but even that does little to fix the fundamental flaws of a half-century mortgage.

His bottom line? A 50-year mortgage might lower a payment, but it keeps people paying well into old age without solving the real problem: a lack of affordable housing supply.